N.B. The information below is a guideline. Companies must check expenses reimbursement in relation to their own business dealings to ensure that all allowances are correct.

Business Entertainment

With so many people now working as contractors or freelance, some business owners get confused on what can and can’t be claimed as expenses for their staff. The bottom line is that unless a business associate is on the payroll as an employee, the cost of taking them out as a thank you for their work is seen as business entertainment. Therefore the business cannot claim any tax relief or claim the VAT back.

Claiming all Food and Drink as a Business Expense

A common misconception by business owners and employees is that they can claim ALL food and drink bought when on business as an expense; however this is not the case. Tax relief can only be claimed on refreshments if they are bought outside normal working patterns, i.e. not the usual 9am-5pm. This can be hard to define, but the simplest and most common practice is that the majority of expenses claimed in this manner would be if someone who is usually office bound is away on business overnight or paying for lunch over a client meeting.

Vehicle Expenses

The majority of SMEs will have employees who use their personal car for business purposes, for example a field sales executive. Any costs incurred in this nature by employees are tax free. There are two simple ways to keep a record of these expenses; however some companies make the mistake of combining the two.

- Vouched Expenses – the most accurate method, an employee will collect and submit receipts for fuels costs for which they will be reimbursed by the employer. As well as submitting receipts, the employee has to keep a record of the reasons and distance of travel.

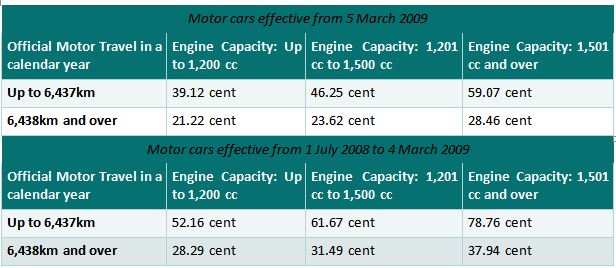

- Flat Rate Kilometric Allowance – the most common method, these allowances are calculated using a standard system to decide the expenses which should be reimbursed by the employer to the employee. The total amount of kilometres travelled in a year by one employee is noted and they are compensated on the following rates as stated on revenue.ie:

Employee Mobile Phone Use

If an employee is on the road a lot, many companies will provide a mobile phone for their use. Phones provided by and in the name of the employer are tax exempt, however if an employee is reimbursed for using their own phone, a different tax will apply and ONLY business calls will be exempt from tax. If the employee uses their own phone for business calls, it can be difficult for Revenue to determine which of those are business calls and which are personal; therefore all calls may be deemed as taxable.

Not Keeping or Losing Receipts

Quite often with SMEs and sole traders, personal money is used on costs for the business. Although it is advised to try and use one account for business costs, tax relief can still be claimed if a record has been kept of expenses, e.g. bank statements if paid for by card. If cash has been used then a receipt must be kept to claim any expense.

As a general guide, please see below benefits that are either exempt from tax or can be taxed efficiently, as noted on revenue.ie:

- Provision of bus/train passes for one month or more

- Bicycle and safety equipment under the Cycle to Work Scheme

- Certain share and approved profit sharing schemes

- Canteen facilities

- Reimbursement of expenses necessarily incurred in the course of employment

- Some accommodation provision

- Lump sum and certain redundancy payments

- Working clothes

- Non-cash personal gifts not related to employment

- Employer's contribution to statutory or revenue approved pension schemes.

- Mobile telephones, computer equipment and home high-speed internet connections where those benefits are provided for business use. (Private use is incidental.)

- Private use of company van which is essentially for the purposes of employee's work and where there is an employer requirement to bring the van home and where other private use is prohibited and the employee spends most of their working time away from the workplace to which they are attached.

As with all areas in a business, it is important to have an expenses policy in place so that all managers and employees know what they can claim against and the procedure to follow. As always it’s important to note that employers should aim to have their finances in order throughout the year and especially go over company accounts in sufficient time before they have to be filed.

The contents of this article are necessarily expressed in broad terms and limited to general information rather than detailed analyses or legal advice. Specialist professional advice should always be obtained to address legal and other issues arising in specific contexts.

RSS Feed

RSS Feed